The Labour Ministry of Saudi Arabia introduced the Wage Protection System (WPS) in 2009 and made it mandatory in 2013 for all private-sector companies operating in the Kingdom. The system has since evolved to significantly simplify compliance for private companies operating in the country.

One of the main purposes for the WPS is to ensure the timely and accurate payment of employees working in the country, safeguarding Saudi and expatriate employees in the private sector.

WPS

Until late-2020, all private-sector companies with more than 10 employees had to register with the payroll system that their banks provide.

The WPS is an electronic system used in Saudi Arabia to create a database of salary payments of workers in the private sector.

All private sector companies must now register in the WPS regardless of their size.

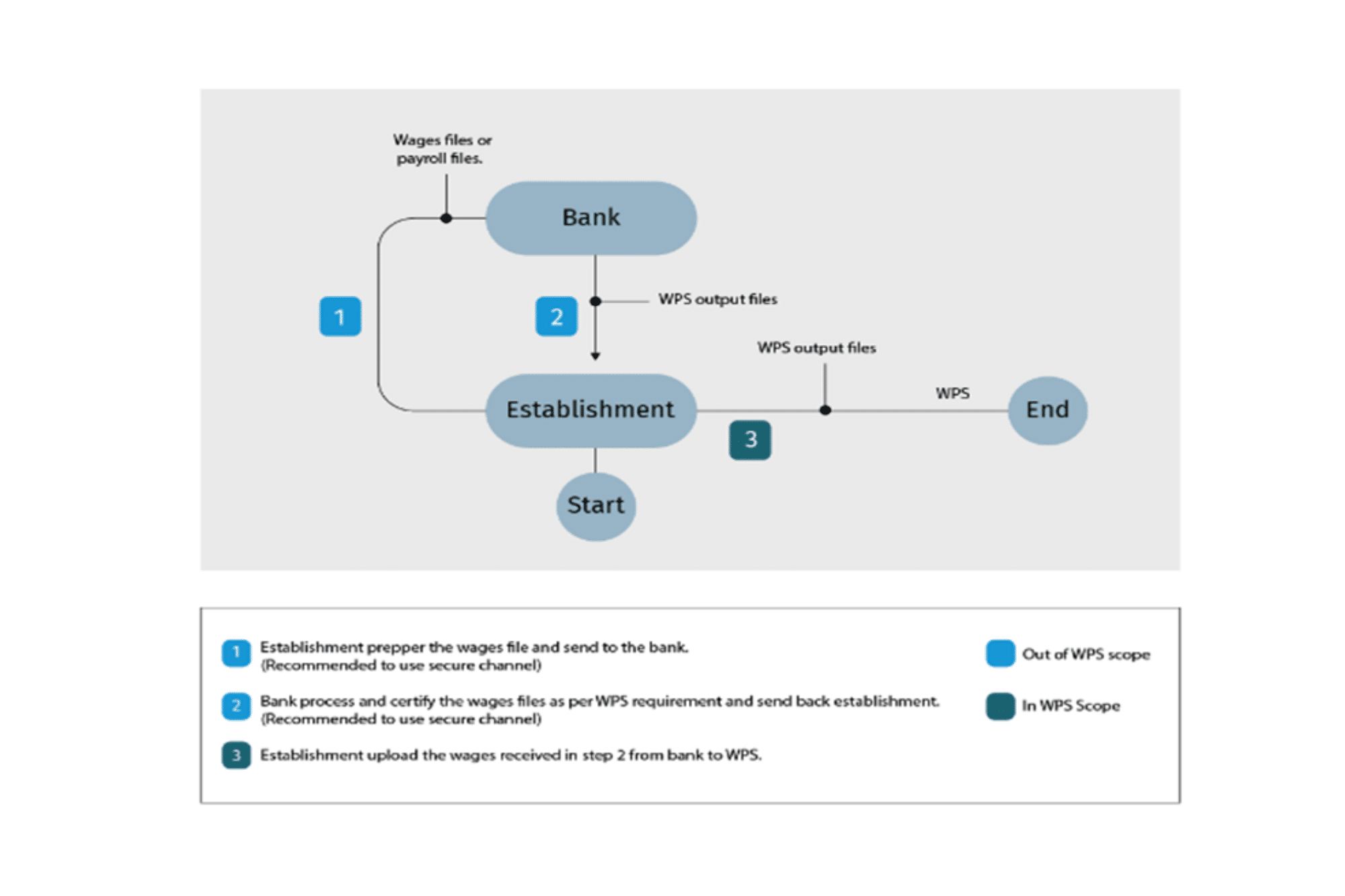

The process of WPS comlliance is that companies must fill in the payroll file each month and upload it to the bank system. Your business must be registered with your bank’s payroll system. The bank generates a WPS file that it sends back to the company.

The company then uploads the WPS file received from the bank to the Ministry of Labour portal before the 10th of every month.

The Ministry would send requests for clarification within five days if there are employees to whom the company had not paid a salary, seeking justification for why these employees were not paid. If the withholding of a salary is unjustified, the company is fined.

Credit: Proven

A single platform for SMEs

Until December 2020, a small- to medium-sized company (SME) (up to 1,000 workers) subject to the WPS had to undergo the same process. But then the government introduced the Mudad system.

It is a digital platform specifically for SMEs to assist with the compliance and regulation of wage payments, integrating General Organization of Social Insurance (GOSI), the Saudi Central Bank and the Ministry of Labour.

Mudad makes the transferring of salaries easy through a direct link with the banks and automatic uploading of wages information to the WPS. When companies register their details, including employees and their salary details, all the information registers automatically with GOSI, banks and financial institutions and the WPS. Mudad also offers contract verification to ensure businesses comply.

Platform services

Mudad enables small and medium-sized companies to organise their administrative processes relating to payroll. The following services are included:

- Company data management – all company information goes directly to GOSI.

- Employee management – all employee details go directly to GOSI.

- E-payments – Companies can automatically issue digital wallets and payroll cards.

- Payroll management – Companies can keep a record of payroll data on the platform and process all payroll with deductions, allowances and rewards allocation, all in one place.

The Ministry of Labour still requires WPS-registered companies to pay salaries by the 10th of every month, and the system quickly processes details of unpaid salaries, automatically sending out requests to companies for clarification where breaches exist.

The system also issues fines to companies that fail to pay workers. If fines go unpaid, companies can face suspension.

WPS for large companies

The WPS also applies to companies in the private sector with more than 1,000 employees.

The process is the same for large companies, to upload payroll to their bank system, processed by the bank and returned to the company to submit an electronic file to WPS by the 10th. The Ministry of Labour then investigates any salaries not paid.

WPS best practices

For companies not registered on Mudad, formalise internal practices to help managing WPS processes better.

Map out the WPS life cycle specific to your organization’s payroll and banking cycle. Appoint a person internally to follow and complete the WPS life cycle each month. Develop a process internally to record exceptions – where the company does not pay specific employees in a given month. Ensure the record details specific explanations and actions taken by the company to resolve issues.

Also clearly define communication channels between your company’s HR and payroll departments to make sure employee details are up to date and processed accurately.

Finally, it is up to each company to stay abreast of any changes to the labour laws, compliance and regulatory processes. Make sure your company has someone internally who specifically keeps an eye out for changes and updates.

Why WPS is critical to business operation

We can’t emphasise the importance of WPS adherence enough. If your company does not comply, your business can be seriously affected. You can face penalties, suspension of service from the Labour office, which affects critical functions like work permit renewal for employees, sponsorship transfers, new work visas, to name a few.