Understanding and complying with the intricacies of social insurance in Egypt can be challenging for businesses. Let’s explore these two critical components for Social Insurance – and how our specialized payroll services can assist in streamlining these obligations.

Minimum Wage Changes in 2024:

In Egypt, as of 2024, the national minimum wage has been set at EGP 3,500.00 per month, effective from January 1, 2024.

This wage regulation is applicable for working hours that are either 8 hours daily over a 5-day week or 7 hours daily over a 6-day week, summing up to a standard 42-hour work week.

The establishment and adjustment of the minimum wage are overseen by the National Wage Council in Egypt, ensuring that it aligns with the country’s socio-economic conditions. These measures are implemented under the supervision of the Egyptian Labor Law, aimed at safeguarding the rights of all workers. For more detailed information and updates on Egypt’s minimum wage, one can refer to the Egypt Salaries website.

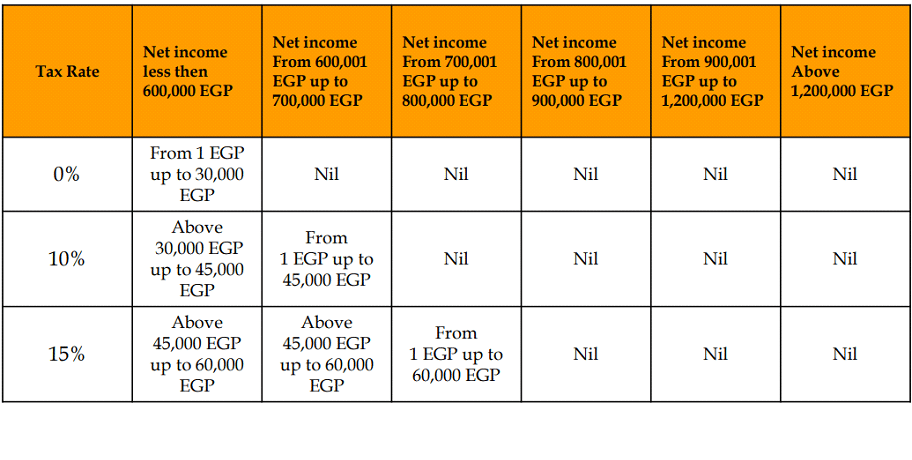

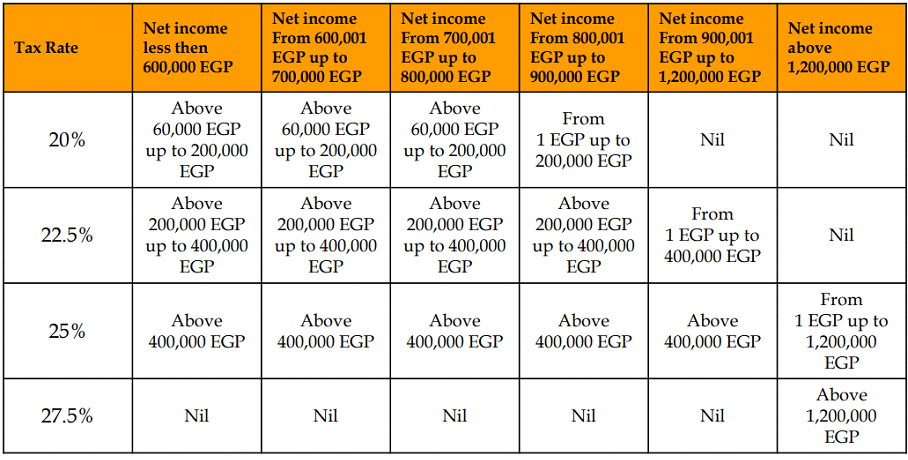

New Income Tax Tables updated by November 2023

As part of the changes to the income tax law, new annual income tax tables have been introduced effective November 1, 2023. These tables outline the tax rates that apply based on total taxable income:

Why Choose Our Payroll Solutions: Opting for our payroll services in Egypt translates into a streamlined, compliant, and error-free payroll process.

Our services include:

⦁ Seamless Integration: Our solutions integrate effortlessly with your existing business systems, ensuring an uninterrupted and efficient payroll process.

⦁ Data Privacy Assurance: We uphold the highest standards of data privacy, ensuring the security and confidentiality of your financial and personal information.

⦁ Zero Error Commitment: Our expert team, equipped with state-of-the-art tools, guarantees precision in payroll processing, eliminating the risk of errors.

In summary, navigating the complexities of tax and social insurance in Egypt requires detailed attention and current knowledge of local regulations. OPS as an outsourcing payroll solutions company, are tailored to address these challenges, allowing your business to focus on its core activities while we expertly manage your payroll obligations with precision and care.